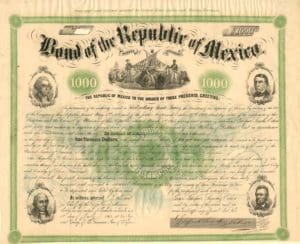

Grabar Law Office is investigating an alleged scheme to restrain trade in the Mexican Government Bond market following ongoing investigations by Mexico’s antitrust regulator, the Comisión Federal de Competencia Económica (COFECE), which have uncovered evidence of anti-competitive conduct in the marketplace for Mexican Government Bonds (“MGBs”). Certain investment banks allegedly rigged auctions through collusive bidding and information sharing, selling MGBs such as Cetes, Bondes D, Bonos, and Udibonos at artificially high prices and agreed to fix the “bid-ask” price in order to increase the asking price at which they were sold.

Last April, the COFECE released its findings, with the head of the investigatory authority, Carlos Mena Labarthe, stating, “The damage to public finance and investors could be serious, considering that every year the government places hundreds of billions of Mexican pesos in these markets and that the daily volume of the instruments traded may reach approximately 100 billion Mexican pesos.” It has been reported that one of the entities subject to the investigation had been granted leniency for its violations. Mexico only offers such leniency when the entity has shown that it directly participated in a cartel.

The conspiracy allegedly financially impacted all persons that entered into an MGB transaction between at least January 1, 2006, and April 19, 2017, where such persons were either domiciled in the United States or its territories or, if domiciled outside the United States or its territories, transacted in the United States or its territories.

If you transacted in MGBs at any time between January 1, 2006, and April 19, 2017 and would like to learn more, contact us at (267) 507-6085 or jgrabar@grabarlaw.com.